Internet Computer (ICP) was also an underperformer, down 2% from Monday.

Index

WisdomTree’s head of digital assets, Will Peck, anticipates that exchange-traded funds (ETF) that hold diversified baskets of cryptocurrencies will fill a significant gap in the market in the coming years.

“It does seem like that’s going to be one of the next waves of adoption,” Peck told Cointelegraph at The Bridge conference in New York City on Wednesday. “It solves a need, I think,” he added.

Peck explained that although many new investors now understand the concept of Bitcoin (BTC), they often struggle to judge the “next 20 range of assets.” He said a multi-asset crypto basket provides them with exposure to the sector while mitigating the “idiosyncratic risk” of investing in individual tokens.

Will Peck says index ETF investors will be backing the tech

“Crypto we talked about as an asset class, but it’s really a technology, and the underlying return drivers of each of these tokens are actually quite different, even though they’re correlated, generally, just because that’s where the market is,” he explained.

It comes as several crypto index ETFs have launched this year. Most recently, on Thursday, asset manager 21Shares launched two crypto Index ETFs, which are regulated under the Investment Company Act of 1940.

Just a couple of months prior, on Sept. 25, asset manager Hashdex expanded its Crypto Index US ETF to include XRP (XRP), SOL (SOL), and Stellar (XLM), following the generic listing rule change from the Securities and Exchange Commission (SEC).

Peck said the timing of broader adoption for crypto index ETFs is “tough exactly to forecast,” but suggested it may be inevitable given the straightforward utility of having a product that provides such exposure.

Peck expects a surge in new crypto ETF launches as ETF issuers compete for early advantage, which he said may erode the idea that an ETF automatically signals the cryptocurrency token has any authority or credibility.

Bitcoin ETF success “surpassed” Will Peck’s expectations

“I think it’s going to be a shift, like, where, five years ago, you said, Oh, if something has an ETF, like, Bitcoin is going to get one, maybe it’s the first one, it must have some sort of institutional stamp of, like, approval,” he said.

“I don’t think that’s necessarily how the SEC should be, a merit-based regulator in that regard, right? And it’s really going to be on clients making the right choices with their own money,” Peck added.

Meanwhile, Peck said that the “overall success” of spot Bitcoin ETFs since their launch in January 2024 has surpassed his expectations.

Related: Crypto treasuries and blockchain are paving the way for decentralized science

“It’s remarkable to me how big the Bitcoin ETF categories, crypto in general, is one of the most competitive parts of the US ETF market,” he said.

Since the launch of US-based spot Bitcoin ETFs, the products have accumulated around $58.83 billion in net inflows, according to Farside.

Magazine: 2026 is the year of pragmatic privacy in crypto: Canton, Zcash and more

The crypto market’s Fear & Greed Index flipped sharply to “fear” this week, falling to levels last seen in April, as a market sell-off erased over $230 billion in a single day.

On Friday, CoinMarketCap’s Crypto Fear & Greed Index, which tracks volatility, market momentum, social media trends and dominance metrics, fell to a low of 28, which is within the “fear” category and is inching closer to “extreme fear.”

CoinMarketCap data showed that on Friday, the total crypto market capitalization dropped to about $3.54 trillion, a 6% drop from $3.78 trillion the previous day. This wiped out over $230 billion in value from the sector, marking one of the sharpest single-day declines in months.

The Fear & Greed Index for traditional assets also fell to 22, signaling extreme fear in the market, following US stocks closing lower on Thursday as the credit market turmoil, regional banks’ exposure to bad loans and US-China trade tensions spread jitters on Wall Street.

Top crypto assets continue to bleed

Data shows that major crypto assets extended their declines in the last 24 hours as the broader market correction deepened.

Bitcoin (BTC) fell nearly 6% to about $105,000, while Ether (ETH) dropped almost 8% to about $3,700. Among large-cap altcoins, BNB (BNB) led losses with a nearly 12% decline, followed by Chainlink (LINK) with an 11% drop and Cardano (ADA), which dropped 9%.

Solana (SOL) and XRP (XRP) also tumbled by over 7%, extending a week-long decline that erased double-digit gains accumulated earlier this month.

On average, the largest non-stablecoin crypto assets declined by about 8%–9% over the last 24 hours.

While last week’s market crash led to nearly $20 billion in liquidations, this week’s downturn saw significantly lower activity.

On Friday, data from CoinGlass showed that about $556 million worth of leveraged positions were wiped out across exchanges, a tiny fraction of last week’s figure.

From this amount, about $451 million came from long positions, while $105 million came from short liquidations.

Related: Gold market cap soars to $30T, dwarfing Bitcoin and tech giants

NFTs, Memecoins and ETFs react to market sell-off

Apart from top cryptocurrencies, other assets like memecoins, non-fungible tokens (NFTs) and exchange-traded funds (ETFs) were also affected by the recent crash.

Memecoins, which showed small signs of recovery this week, dropped 33% in 24 hours, according to CoinMarketCap. Top memecoin assets experienced declines of 9%–11% over the last 24 hours, while trading volumes remained relatively high, at nearly $10 billion.

The NFT sector, which also rebounded from a $1.2 billion wipeout last week, erased its gains and dropped below a $5 billion valuation, a level last seen in July. CoinGecko data showed that a majority of blue-chip collections dropped double-digit percentages in the last 24 hours.

Meanwhile, spot Bitcoin and Ether ETFs reacted to the crash. On Thursday, spot Bitcoin ETFs recorded outflows of over $536 million, while spot Ether ETFs showed daily net outflows of more than $56 million.

Magazine: Sharplink exec shocked by level of BTC and ETH ETF hodling: Joseph Chalom

Bitcoin Price Crashes to $107,000 As Fear Index Flirts With “Extreme Fear”

Bitcoin Magazine

Bitcoin Price Crashes to $107,000 As Fear Index Flirts With “Extreme Fear”

Bitcoin price has tumbled to the $107,000 range as all markets enter a phase of pronounced caution.

According to the Bitcoin Fear & Greed Index, sentiment currently sits at 28/100, firmly in the ‘Fear’ category. The market would enter the ‘Extreme Fear’ category if the sentiment fell below 25/100.

The index, which gauges market emotion on a scale from 0 (extreme fear) to 100 (extreme greed), is a barometer for investor sentiment, highlighting periods when Bitcoin may be undervalued or overextended.

The current “fear” in the market and ensuing sell-off may be linked to a rising trade tension between the U.S. and China. President Donald Trump is set to address the nation from the Oval Office on Thursday at 3 p.m. EST, though details about the announcement remain unknown.

The Fear & Greed Index has become a popular tool for investors and traders seeking to separate their own emotions from broader market movements.

When fear dominates, it’s often a signal for buying opportunities, as investors may be overreacting to price dips.

Conversely, periods of extreme greed can indicate overheating and heightened risk.

For context, when bitcoin was priced above $124,000 almost two weeks ago, the index was priced above 70, which would be in the ‘greed’ category, according to Bitcoin Magazine Pro data.

JUST IN: #Bitcoin dips to $108,765

HODLpic.twitter.com/l0lYtnihrr

— Bitcoin Magazine (@BitcoinMagazine) October 16, 2025

Bitcoin price recently

Bitcoin’s recent pullback follows a volatile stretch in which the asset surged to all-time highs before retreating.

Over the past several days, Bitcoin has hovered between $110,000 and $112,000, bouncing from oversold levels on the Advanced NVT Signal for the first time since the $75,000 mark.

According to Bitcoin Magazine Pro, these readings suggest Bitcoin may be temporarily undervalued relative to its network activity. As fear dominates the market, traders may be reluctant to commit capital, keeping Bitcoin in a range-bound pattern.

In stark contrast, gold continues its meteoric rise, hitting new all-time highs near $4,270 per ounce. The metal’s year-to-date gain of nearly 60% has outpaced Bitcoin’s roughly 20% growth, reinforcing its status as a safe-haven asset.

Right now, the diverging trajectories of Bitcoin and gold illustrate the split between risk-on and risk-off assets. Bitcoin’s Fear & Greed Index reading of 28 really shows heightened market anxiety, while gold continues to attract investors seeking stability.

This post Bitcoin Price Crashes to $107,000 As Fear Index Flirts With “Extreme Fear” first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

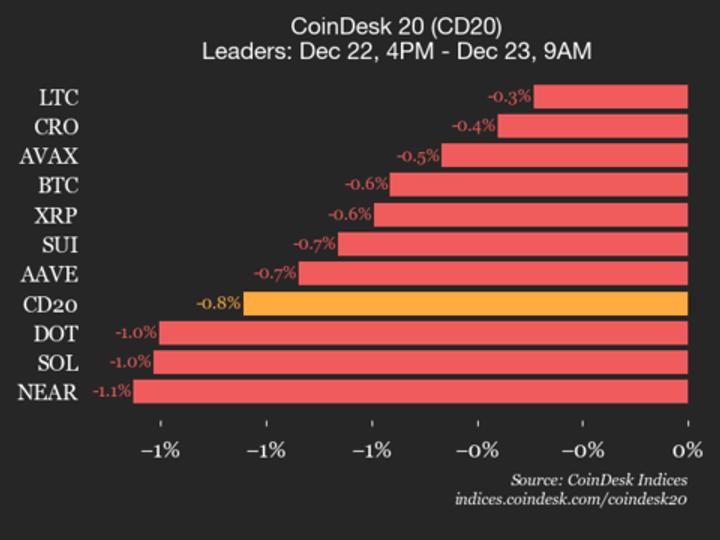

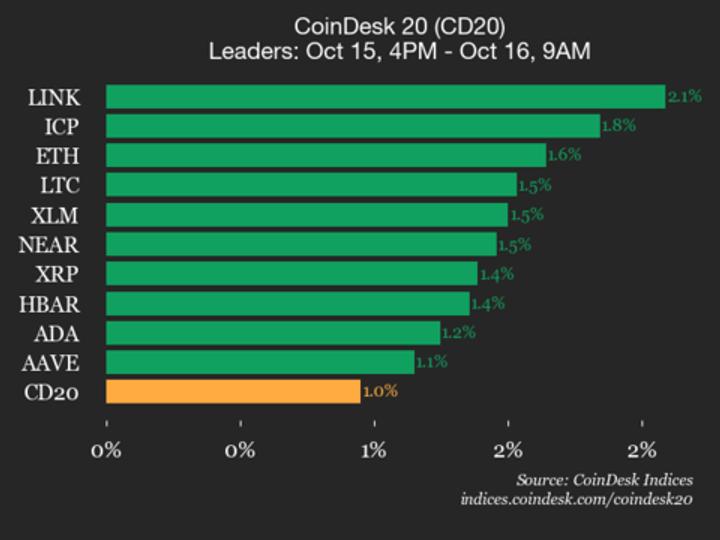

CoinDesk Indices presents its daily market update, highlighting the performance of leaders and laggards in the CoinDesk 20 Index.

The CoinDesk 20 is currently trading at 3734.21, up 1.0% (+35.14) since 4 p.m. ET on Wednesday.

Nineteen of 20 assets are trading higher.

Leaders: LINK (+2.1%) and ICP (+1.8%).

Laggards: FIL (-0.3%) and BCH (+0.1%).

The CoinDesk 20 is a broad-based index traded on multiple platforms in several regions globally.