Karavas, Cyprus, February 17th, 2026, Chainwire

At a time when much of the blockchain industry is still recovering from one of its harshest downturns, a small number of companies are quietly moving in the opposite direction: expanding, building, and positioning themselves for the next era of adoption.

Public Masterpiece, a Cyprus-based real-world asset tokenization company, has announced PMT Chain, its own purpose-built Layer 1 blockchain. Alongside the announcement, the company confirmed a strategic repositioning: PMT, once short for Public Masterpiece Token, will now stand for Public Masterpiece Technology.

The timing is notable. Crypto did not simply experience a correction, but a $1.1 trillion stress test that dismantled inflated narratives and exposed weak token models. Many projects will not return.

Public Masterpiece is positioning itself as one of the exceptions. Even before revealing its Layer 1 ambitions, the company built traction through its Layer 2 presence on BNB Chain. Over the past 12 months, PMT has reportedly increased in price by 75%, outperforming 86% of the top 100 crypto assets, including Bitcoin and Ethereum, while trading above its 200-day moving average and remaining near its all-time high.

CoinMarketCap Screenshot of the Public Masterpiece Token Chart as of 13.02.2026

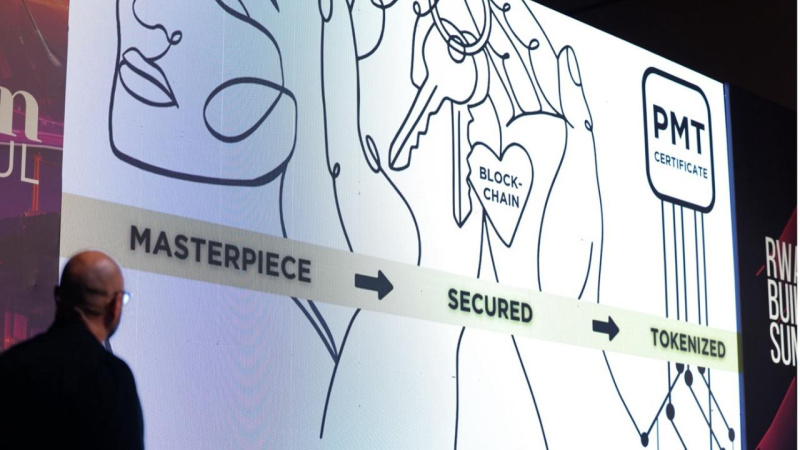

PMT Chain is designed specifically for real-world asset tokenization, with the company positioning the network as infrastructure for internationally renowned museums, galleries, private collectors, and global brands seeking secure and transparent certification solutions.

At the center of the ecosystem will be a Certification Hub in the UAE, staffed by evaluators, art experts, and historians. The goal is to establish an international framework for authenticating and evaluating physical artworks on-chain, addressing long-standing issues such as forgery, provenance manipulation, and the illegal trafficking of art, artifacts, collectibles, and historical goods.

CEO Kamran Arki described the mission with clarity:

“The last market cycle proved one thing: narratives collapse when foundations are weak. PMT Chain was built for real-world value and long-term trust. Museums, collectors, and brands need transparency, security, and permanence. That is exactly what we engineered.”

Public Masterpiece revealed that PMT Chain has been built over seven years, with five years dedicated solely to research and development, a timeline that stands in sharp contrast to the rapid-launch culture of the blockchain sector.

COO Garen Mehrabian emphasized the broader responsibility behind the project:

“Web3 will not reach mass adoption if it feels like a casino. Builders have the responsibility to create systems people can trust and understand. We didn’t build PMT Chain to ride a wave. We built it to create an ecosystem that survives every wave.”

Public Masterpiece Keynote Presentation at the main Stage of the RWA BUILDERS SUMMIT 2025

Public Masterpiece Keynote Presentation at the main Stage of the RWA BUILDERS SUMMIT 2025

While art remains the cultural foundation, Public Masterpiece confirmed that PMT Chain is designed to scale beyond it, including real estate tokenization and broader RWA deployment. The network will also offer white-label tokenization and certification solutions, enabling institutions and companies to integrate blockchain infrastructure without building their own systems from scratch.

Perhaps most notably, Public Masterpiece confirmed that several governments are already in discussions regarding PMT Chain implementation. No names have been revealed, and the company has not announced a launch date. While the blockchain is reportedly ready, the founders have stated it will go live only when the timing is strategically optimal.

In a market where speculation has been punished and confidence is scarce, Public Masterpiece is betting that the next era of blockchain adoption will be defined by infrastructure, not hype.

About Public Masterpiece

Public Masterpiece is a real-world asset tokenization company building blockchain infrastructure designed to support tokenization, certification, and provenance for physical value across art and broader real-world asset markets.

Useful Links:

Contact

Kamran Arki

info@publicmasterpiece.com

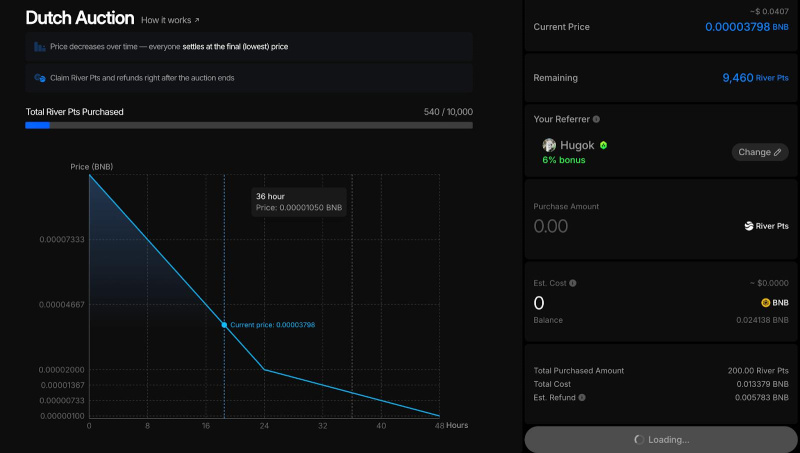

After the 48-hour auction ends, participants can claim all the River Pts, refunds, and

After the 48-hour auction ends, participants can claim all the River Pts, refunds, and